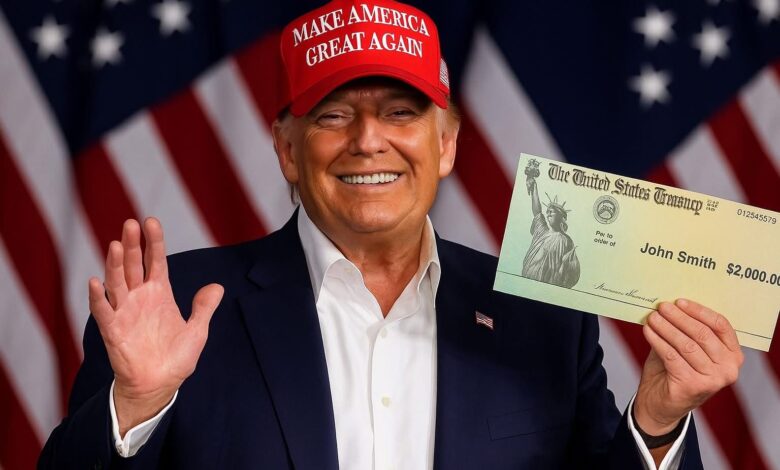

White House Says Trump Committed to $2,000 Tariff Dividend Payments for Many Americans!

The administration made waves this week after announcing that President Donald Trump remained determined to move forward with a proposed $2,000 “tariff dividend” for millions of Americans—an idea that immediately set off political debate, economic speculation, and a flood of public curiosity. The concept, ambitious in scale and controversial in execution, hinges on the idea of redirecting tariff-generated revenue toward direct financial relief while also chipping away at the towering federal debt.

The announcement came during a briefing where White House press secretary Karoline Leavitt emphasized that senior officials were actively evaluating how to legally structure the plan. Behind her measured tone was a clear message: the president wanted this, and advisers were working overtime to figure out how to deliver it. According to Leavitt, the administration had already begun discussing several models that could translate tariff revenue into some form of public financial benefit.

The proposal resurfaced after a weekend burst of social media activity in which Trump celebrated the scale of tariff income flowing into government coffers. He argued that the United States was finally leveraging economic tools aggressively enough to rebalance trade relationships, boost domestic manufacturing, and generate revenue substantial enough to make both debt reduction and public dividends possible. He described the tariff system as a “defensive mechanism” designed to protect American interests, claiming it had already ushered in major industrial investment and job growth.

In a lengthy online post, the president suggested that the government could begin distributing at least $2,000 per adult—excluding high-income families—while simultaneously applying remaining funds to reduce what he repeatedly referred to as the nation’s “enormous” $37 trillion debt. He framed the idea as both reward and remedy: a financial thank-you to Americans for enduring disrupted global markets, and a bold move toward reining in federal liabilities.

While the proposal’s simplicity resonated with many supporters, its mechanics are anything but simple. The Supreme Court is currently weighing a critical case involving the administration’s authority to deploy tariffs under the 1977 International Emergency Economic Powers Act. The Court’s ruling—expected within months—could determine whether the executive branch has the legal footing to continue structuring tariffs this way, let alone repurpose the associated revenue for public payments.

Trump has insisted repeatedly that the administration’s position is sound and that the case represents one of the most consequential constitutional questions of the modern era. His argument centers on presidential power during economic emergencies, asserting that the flexibility to impose tariffs is essential to national security and global competitiveness. Speaking to reporters after the hearing, he declared that a 100 percent tariff on Chinese imports had led to what he described as a “wonderful deal,” emphasizing that no negotiation of that scale would have been possible without tariff leverage.

As legal proceedings unfolded, Treasury Secretary Scott Bessent added another layer to the conversation. While acknowledging the president’s enthusiasm for a direct payment model, Bessent noted that the dividend concept could take multiple forms. Instead of checks, the administration might implement sweeping tax reductions that essentially deliver equivalent value to households earning under $100,000 annually. He highlighted proposals already under discussion: eliminating taxes on tips, overtime, and Social Security benefits. According to Bessent, these moves alone would create substantial financial relief for working families, even without issuing a physical payment.

This alternative approach signaled a broader strategy—one that reflects the administration’s long-standing preference for tax-based relief rather than standalone stimulus checks. Whether the dividend emerges as tax cuts, direct payments, or some hybrid model remained an open question as advisers continued examining what was feasible under federal law.

What is clear is that the administration is intent on shaping the narrative: the tariffs, they argue, are doing more than punishing foreign competitors—they are financing domestic opportunity. Trump has repeatedly asserted that the United States is taking in “trillions,” a claim meant to reinforce public confidence in the dividend proposal. Critics counter that tariff revenue is subject to economic volatility and global retaliation, making long-term commitments risky. Supporters respond that strong enforcement finally gives the U.S. leverage it has lacked for decades.

Earlier in the year, Trump floated a separate idea involving savings produced by the Department of Government Efficiency—an initiative advertised as a streamlined internal audit aimed at eliminating redundant expenditures. In theory, the accumulated savings could have funded a one-time payment to every American worker. The idea generated headlines but faded as other legislative priorities took center stage. Now, with the revived dividend proposal, some analysts wonder whether the administration intends to combine both strategies into a larger package.

Behind the political theatrics lies a more personal reaction among everyday Americans. Many welcomed the prospect of a $2,000 relief measure, especially as living costs continue to climb. Others expressed skepticism, worried that the program may never materialize or that income-based exclusions could prevent millions from qualifying. Economic experts echoed the uncertainty, noting that while tariff revenues do contribute to federal income, they typically represent a fraction of what would be needed to sustain recurring payments of this scale.

Nevertheless, the administration’s messaging remained unwavering: Americans should expect a financial boost funded by the very policies designed to protect them. As discussions evolve, the White House continues to frame the dividend as a patriotic redistribution—turning the costs of global competition into domestic reward.

The weeks ahead promise continued debate, legal developments, economic analysis, and speculation about the final structure and viability of the proposed payments. Whether delivered through checks, tax cuts, or a combination of policy tools, the administration insists that financial relief is coming.

For now, the country waits in a strange mix of anticipation and caution—watching court decisions, monitoring legislative shifts, and hoping that whatever form the dividend takes, it will arrive as more than just a political talking point.