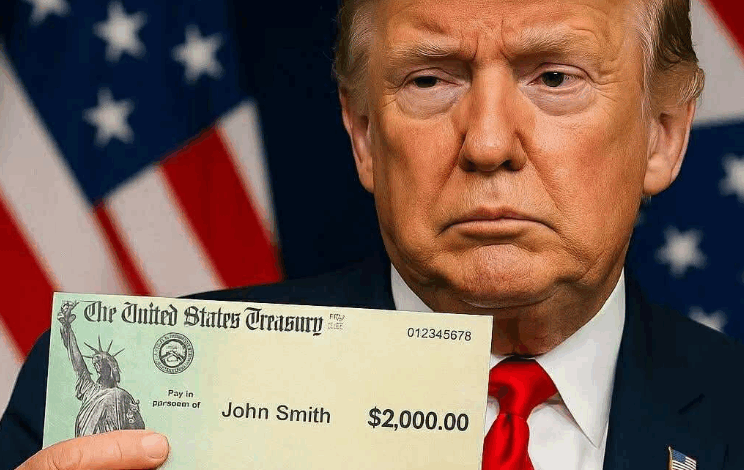

Breaking – Trump Promises $2,000 Tariff Dividend for All Americans! Says Opposing Tariffs Is Foolish

For days, rumors swirled across political circles, social media, and news commentary shows. Something big was coming, something tied to the economy, something bold enough to grab national attention. By Sunday morning, the suspense broke. President Donald Trump announced on Truth Social that he intended to deliver a $2,000 “tariff dividend” to every American — a payout he said would be funded entirely by revenue from tariffs imposed on foreign nations during his administration. The revelation sent shockwaves through supporters and critics alike, immediately igniting a new round of debate over money, legality, motive, and timing.

Trump framed the announcement in classic fashion: direct, triumphant, and confrontational. He described tariffs not as burdens but as powerful financial engines that have poured immense revenue into the United States. In his words, the dividend wasn’t charity — it was a rightful return to the American people, a distribution of money generated by what he called strategic economic warfare. Tariffs, he insisted, had strengthened national finances, lifted 401(k)s, and — in his view — fueled prosperity without driving up inflation. He even took aim at those who oppose tariff policies, calling them “FOOLS!” for misunderstanding what he sees as one of the country’s greatest economic weapons.

The announcement didn’t come out of nowhere. It arrived just days after the Supreme Court examined whether the administration could legally use emergency powers to impose sweeping tariffs across nearly every trading partner. That legal pressure added a layer of urgency — or desperation, depending on who you ask — to Trump’s timing. Critics argue he is trying to solidify public support before the Court delivers a ruling that could strip away some of those tariff powers or even force billions in refunds. Supporters counter that he’s simply returning revenue that belongs to the people.

Treasury Secretary Scott Bessent, attempting to add clarity, appeared on ABC’s This Week and hinted that the $2,000 might not land as physical checks. Instead, he said Americans may receive the dividend in the form of tax reductions — a quieter, less flashy format, but still a direct financial benefit. His comments triggered a fresh wave of speculation about whether the dividend is a policy in development or a political promise looking for a structure.

The numbers fueling this whole debate are enormous. Between April and October, U.S. import duties collected around $151 billion. Some projections, boosted by the administration’s own confidence, claim tariffs could generate $500 billion or more annually under expanded enforcement. For comparison, the $2,000-per-person stimulus plan from the pandemic era cost about $464 billion. If the revenue numbers are accurate — and that’s a point economists fiercely question — Trump’s proposal sits within the realm of theoretical possibility. But many analysts argue the revenue would need to be sustained consistently, something tariff systems have historically struggled to deliver without destabilizing consumer costs.

Trump, however, is leaning into the symbolism as much as the math. The dividend taps into a deep emotional well among Americans who feel squeezed by inflation, housing costs, debt, and stagnant wages. It resurrects the populist tone that defined his political rise: ordinary people getting something back from a government they feel has overlooked them. The message is less about spreadsheets and more about tapping into the frustration of families who are tired of stretching their paychecks while global corporations and foreign governments seem to benefit from complex trade rules.

Still, skepticism is loud. Ohio Senator Bernie Moreno voiced what many fiscal conservatives have been shouting for years: “It’ll never pass. We’ve got $37 trillion in debt.” Others warn that creating a national dividend from tariff revenue might require Congress to restructure large portions of federal budget law — a battle guaranteed to be brutal, slow, and politically costly. If the Supreme Court decides Trump’s emergency tariff powers were unconstitutional, billions of dollars collected could be subject to repayment, blowing a hole in any plan to redistribute the revenue.

Not all tariffs are on shaky ground. Duties placed on steel, aluminum, and automobiles appear legally stable for now, and Trump has historically used these tariffs as bargaining tools in negotiations with countries like China and Mexico. That strategic use adds another complication: if tariffs are both diplomatic leverage and domestic revenue generators, any program tied to them becomes entangled in foreign policy decisions.

Despite all the caveats, Trump’s announcement rallied his base in a week when Republicans needed momentum. They had just taken a hit from Democratic victories in key blue-state elections, where frustration over rising living costs played a major role. A promise of financial relief — whether through checks or tax cuts — offered supporters something clear and energizing to hold onto.

Even those critical of Trump acknowledge the political sharpness of the move. It speaks directly to working Americans who feel bruised by inflation and disillusioned with slow-moving economic reforms. It repositions tariffs — usually a dry and technical topic — as a personal issue tied to people’s wallets. In an era where political loyalty often rises and falls based on economic security, the announcement landed with force.

In the broader national conversation, the $2,000 tariff dividend quickly became more than a proposal. It became a reflection of the underlying tension between political promises and the economic realities that shape them. Americans want relief, predictability, and financial stability, but they’ve also grown wary of big announcements that lack clear paths. Many people watched Trump’s statement with hope, even excitement, but just as many watched with raised eyebrows, remembering past promises that stalled out in Congress or collided with legal barriers.

What’s clear is that the proposal, whether ultimately achievable or not, underscores the challenge of running modern economic policy in a world of exploding national debt, global trade battles, and hyperpolarized politics. Tariffs remain one of the most polarizing tools in the government’s economic arsenal — praised as protection for American jobs and condemned as hidden taxes on consumers. Turning them into a national dividend adds a new layer of complexity.

For everyday Americans, though, the political chess game matters far less than the bottom line. People want to know if money will arrive, how soon, and in what form. They want certainty in a time when everything feels unstable. Trump’s announcement delivered a headline that sparked hope and controversy in equal measure. But behind the headline lies the harder truth: policies that sound simple in a social media post become much more complicated when confronted with law, math, and bureaucracy.

Whether the dividend becomes reality or dissolves into another chapter of political theater, it has already achieved one thing: it captured the nation’s attention. It reminded people how deeply economic security shapes their lives and how quickly a bold promise can shift the national mood. And it pushed the conversation back to a central question: who truly benefits from America’s wealth, and how should that wealth be shared?

For now, the $2,000 tariff dividend sits somewhere between ambition and uncertainty — a proposal with enormous appeal, tangled in a web of legal, financial, and political obstacles. But it has sparked a debate the country won’t walk away from anytime soon.