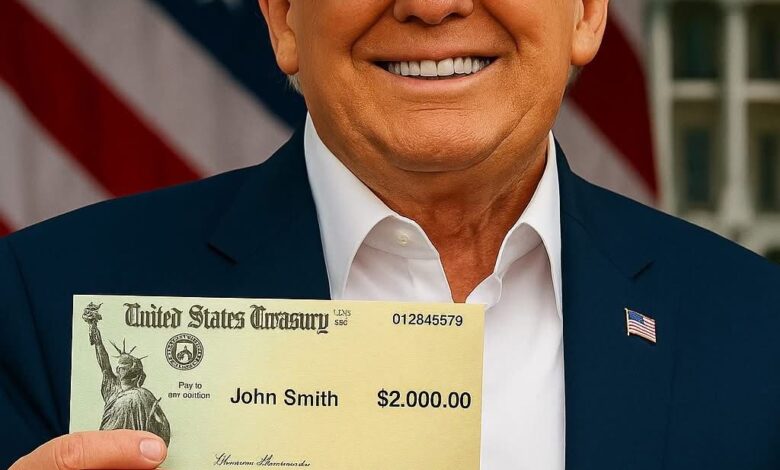

Trump Promises $2,000 Tariff Dividend for All Americans! Says Opposing Tariffs Is Foolish

For days, speculation had been building about a dramatic economic move coming out of the White House. Analysts argued, pundits theorized, and political corners buzzed with rumors about whether President Trump would attempt something unprecedented. On Sunday morning, he confirmed it himself. Through a post on Truth Social, the president announced that he intends to give every American a “$2,000 tariff dividend,” an idea he described as both patriotic and economically brilliant. According to him, the money would be drawn entirely from tariff revenue generated by his administration’s sweeping duties on countries around the world.

Supporters immediately praised the idea, calling it bold, populist, and overdue. Critics didn’t hesitate either—they questioned the legality, the math, and the timing. And timing mattered. The promise landed just days after the Supreme Court spent hours dissecting whether the administration actually has the constitutional authority to invoke emergency powers to impose such broad tariff measures in the first place. That looming decision casts a long shadow over everything that followed.

Still, Trump doubled down. He claimed the dividend would be delivered to “all Americans, not the rich ones,” and insisted that tariff revenue was more than capable of funding such a payout. He touted what he called the administration’s success with tariffs, saying they had generated “trillions” in revenue, boosted 401(k)s to record levels, maintained low inflation, and exposed critics as “FOOLS!” His message was not subtle: tariffs were the future, and anyone who opposed them was stuck in the past.

Treasury Secretary Scott Bessent attempted to add some clarity during an appearance on ABC’s This Week. He suggested that the proposed $2,000 might not arrive as straightforward cash, but as some alternative form of financial benefit still under discussion. He avoided specifics, leaving the public guessing about the plan’s actual structure—tax credit, direct deposit, voucher, rebate, or something entirely new. What mattered for the moment was that the administration wanted Americans to believe the money was on its way.

On paper, the numbers appear impressive. From April to October alone, import duties generated an estimated $151 billion. Projections pushed those figures much higher, suggesting that annual revenue could reach $500 billion or more if the tariffs remain in place and withstand legal scrutiny. But comparing government revenue to promised payouts paints a murkier picture. The cost of a universal $2,000 dividend could reach hundreds of billions—far more than what critics say tariff income can realistically sustain. Even some Republicans balked at the math.

Senator Bernie Moreno didn’t mince words when asked about the proposal. “It’ll never pass,” he said. “We’ve got $37 trillion in debt. We don’t have this kind of money.” That sentiment echoed through much of the Senate, where fiscal hawks bristled at the promise of another direct payment program layered on top of an already strained federal budget.

Legal uncertainty hangs even heavier than financial doubt. If the Supreme Court rules against the administration’s use of emergency powers, it could trigger refund obligations worth billions. Several trade partners have already challenged the tariffs, arguing they violate both U.S. law and international agreements. If the justices side with them, the White House could find itself in the awkward position of promising Americans money that the government must instead return to foreign exporters.

Some tariffs, like those on steel, autos, and aluminum, appear more secure for now. They’ve been integrated into ongoing trade negotiations and national security arguments, giving them sturdier legal footing. But many of the newer, broader tariffs remain vulnerable. Trump has used them aggressively in foreign policy—leveraging them to pressure adversaries, reward allies, and shape political narratives at home. That blurs the line between economic strategy and electoral calculus, which critics say is precisely the problem.

The political implications aren’t subtle. The announcement came on the heels of a brutal week for the GOP. Democratic candidates in several blue states capitalized on voter frustration over rising costs, healthcare strains, and housing pressures. Losses in those races hit Republicans harder than expected, prompting internal panic and demands for reset. The tariff dividend, whether realistic or not, immediately reshaped the conversation. It pushed the narrative from voter anger to voter reward. It told Americans: “Stick with us and you will get tangible benefits.”

Whether that promise was strategic timing or coincidence depends on who you ask.

Economists remain deeply split. Some argue that tariffs, when used sparingly and targeted correctly, can produce revenue without triggering runaway inflation. Others warn that treating tariffs as a piggy bank is reckless—higher import costs tend to ripple down to consumers. If the administration insists tariffs have caused “NO inflation,” as Trump claimed, critics counter by pointing to grocery prices, fuel costs, and basic goods that have soared despite official inflation metrics.

Then there’s the matter of practicality. Even if tariffs could theoretically fund a dividend, how would it be delivered? Would the IRS administer it? Would eligibility be tied to tax records? How would the government prevent fraud? And what happens in years when tariff revenue dips?

The administration hasn’t answered those questions. For now, the message is simple: tariffs pay, Americans benefit, and anyone opposed is standing in the way of prosperity.

But beneath that simple message lies a dense web of legal battles, budget constraints, international tension, and political maneuvering. The dividend idea—bold, dramatic, headline-grabbing—functions as both a promise and a provocation. It energizes Trump’s base, rattles his opponents, and muddies the waters ahead of the Supreme Court’s ruling.

If the plan ever becomes reality, Americans may one day see a direct financial benefit from tariffs. If not, this moment will likely be remembered as an example of how modern politics turns economic policy into viral content. Either way, the announcement exposes an uncomfortable truth: in a political era ruled by spectacle, the gap between a president’s social media post and the country’s legal and economic reality can be enormous.

And while the idea of a $2,000 “tariff dividend” sounds simple on the surface, the road from slogan to actual money is anything but.

That’s the real story—one no amount of capital letters or online applause can hide.